The Statutes of Limitations for Each State

Each state has its own statute of limitations on debt, which is the amount of time the court will force you to pay a debt. The statute of limitations varies depending on the type of debt you have such as credit card debt or a loan. Usually, it is between three and six years, but it can be as high as 10 or 15 years in some states. Before you respond to a debt collection, find out the debt statute of limitations for your state.

Here's a rundown of the statute of limitation state-by-state, as of July 2018:

| State | Oral | Written | Promissory | Open |

|---|---|---|---|---|

| Alabama | 6 | 6 | 6 | 3 |

| Alaska | 3 | 3 | 3 | 3 |

| Arizona | 3 | 6 | 6 | 3 |

| Arkansas | 3 | 5 | 3 | 3 |

| California | 2 | 4 | 4 | 4 |

| Colorado | 6 | 6 | 6 | 6 |

| Connecticut | 3 | 6 | 6 | 3 |

| Delaware | 3 | 3 | 3 | 4 |

| Florida | 4 | 5 | 5 | 4 |

| Georgia | 4 | 6 | 6 | 6 |

| Hawaii | 6 | 6 | 6 | 3 |

| Idaho | 4 | 5 | 5 | 5 |

| Illinois | 3 | 6 | 6 | 3 |

| Indiana | 3 | 5 | 3 | 3 |

| Iowa | 5 | 10 | 5 | 5 |

| Kansas | 3 | 5 | 5 | 3 |

| Kentucky | 5 | 10 | 15 | 5 |

| Louisiana | 10 | 10 | 10 | 3 |

| Maine | 6 | 6 | 6 | 6 |

| Maryland | 3 | 3 | 6 | 3 |

| Massachusetts | 6 | 6 | 6 | 6 |

| Michigan | 6 | 6 | 6 | 6 |

| Minnesota | 6 | 6 | 6 | 6 |

| Massachusetts | 6 | 6 | 6 | 6 |

| Michigan | 6 | 6 | 6 | 6 |

| Minnesota | 6 | 6 | 6 | 6 |

| Mississippi | 3 | 3 | 3 | 3 |

| Missouri | 5 | 10 | 10 | 5 |

| Montana | 5 | 8 | 8 | 5 |

| Nebraska | 4 | 5 | 5 | 4 |

| Nevada | 4 | 6 | 3 | 4 |

| New Hampshire | 3 | 3 | 6 | 3 |

| New Jersey | 6 | 6 | 6 | 6 |

| New Mexico | 4 | 6 | 6 | 4 |

| New York | 6 | 6 | 6 | 6 |

| North Carolina | 3 | 3 | 5 | 3 |

| North Dakota | 6 | 6 | 6 | 6 |

| Ohio | 6 | 8 | 15 | 6 |

| Oklahoma | 3 | 5 | 5 | 3 |

| Oregon | 6 | 6 | 6 | 6 |

| Rhode Island | 10 | 10 | 10 | 10 |

| South Carolina | 3 | 3 | 3 | 3 |

| South Dakota | 6 | 6 | 6 | 6 |

| Tennessee | 6 | 6 | 6 | 6 |

| Texas | 4 | 4 | 4 | 4 |

| Utah | 4 | 6 | 6 | 4 |

| Vermont | 6 | 6 | 5 | 3 |

| Virginia | 3 | 5 | 6 | 3 |

| Washington | 3 | 6 | 6 | 3 |

| West Virginia | 5 | 10 | 6 | 5 |

| Wisconsin | 6 | 6 | 10 | 6 |

| Wyoming | 8 | 10 | 10 | 8 |

DISPUTE VS CHALLENGE

At Kredit Korner, we focus on Credit Enhancement by using Metro 2 Compliance to challenge negative or erroneous information on your credit report. Below we break down why and how Metro 2 takes part of our success. DISPUTE: Is an argument of the fact of truth, the fact of correctness or the facts of completeness. Where as a CHALLENGE, we ask for certification of truth, correctness and completeness of such item. We are not saying DISPUTE methods don't work. What we are saying is that we have taken a different approach and we are getting amazing results.

The Process

The process begins by challenging the compliance of negative and inaccurate information on your credit report, with the 3 major credit bureaus and suppressing/freezing (ghost) third party companies used for verification to get maximum results. Understanding METRO 2 COMPLIANCE, these items can now be enhanced legally, ethically and efficiently.

Why we use METRO 2 Compliant?

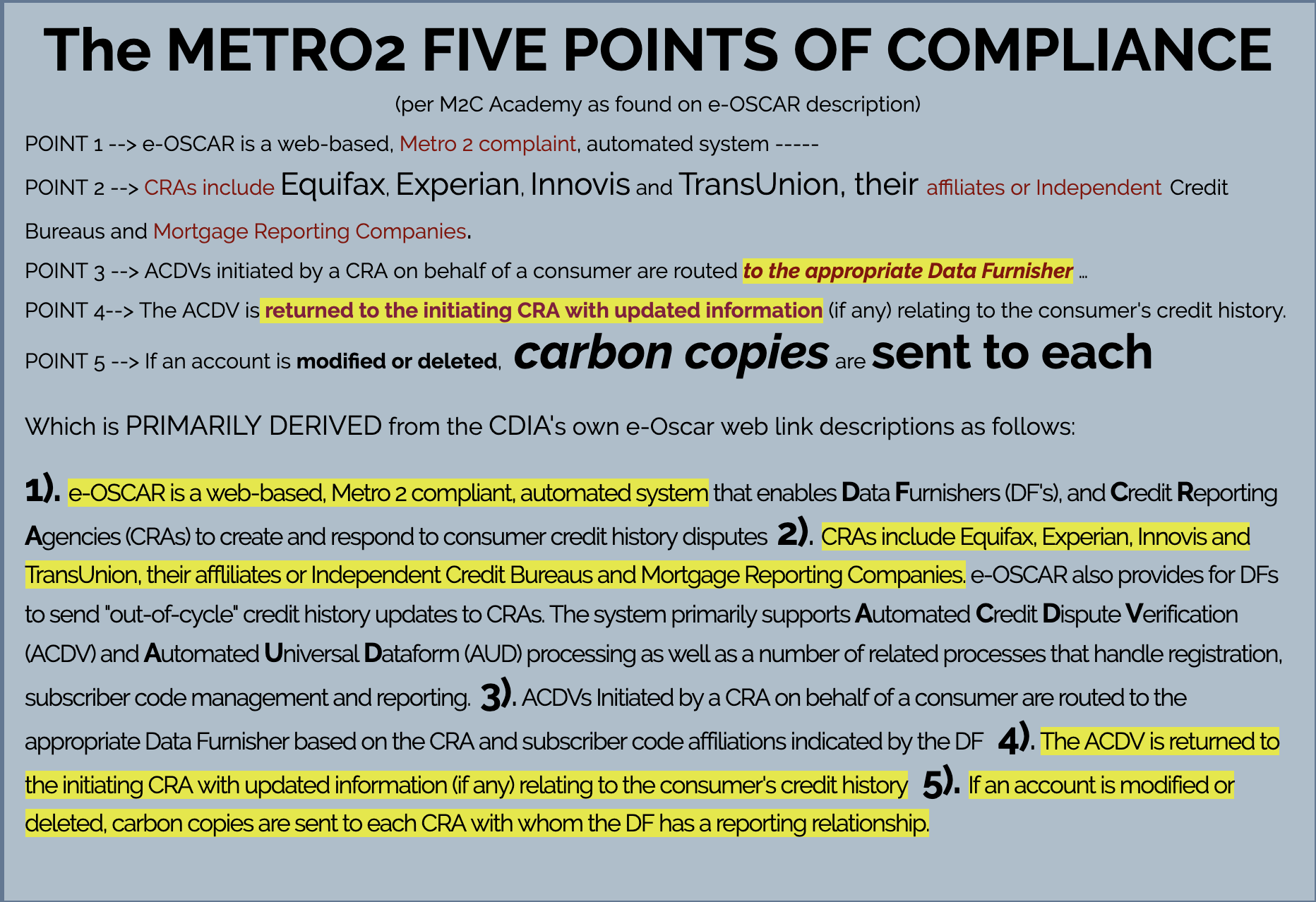

We understand that most (to all) letters are being reviewed by the e-OSCAR system. So, what is e-OSCAR? e-OSCAR is a web-based, Metro 2 compliant, automated system that enables Data Furnishers (DFs), and Credit Reporting Agencies (CRAs) to create and respond to consumer credit history disputes. CRAs include Equifax, Experian, Innovis and TransUnion, their affiliates or Independent Credit Bureaus and Mortgage Reporting Companies.

THE METRO 2 COMPLIANCE METHOD

HERE at Kredit Korner, we execute all consumer enhancement efforts utilizing the METRO 2 COMPLIANCE METHOD which includes but is NOT LIMITED TO the unique and proprietary strategies, tactics, terminology, and philosophy.

ESSENTIALLY, the M2C Method is concerned with PROCESS OF REPORTING of VALID DATA whereas TRADITIONAL or DISPUTING MODELS/METHODS such as SECTION 609/Section 623 tactics argue against TRUTH AND VALIDITY of the item being REPORTED! OBVIOUSLY, the difference is SIGNIFICANTLY MORE than just THAT, but THAT IS IN FACT THE FOUNDATION for the DIFFERENCES between the M2C Method's REQUESTS/CHECKS/& CHALLENGES as compared to ANY TRADITIONAL Method's DISPUTING!

The M2C Method also FOCUSES on what is referred to as the TMF ASPECT aka TOO MUCH FACTOR aspects for success in credit report health enhancement(s) and credit score wealth enrichment(s).

The METRO 2 FIVE POINTS of COMPLIANCE aka M2FPOC

BASED ON THE METRO 2 COMPLIANCE METHOD strategies we utilize here, ALL NEGATIVELY REPORTED information AND NEUTRALLY REPORTED INFORMATION AS WELL will be reviewed to determine if its REPORTING STATUS is POTENTIALLY ALTERED based on IF OR NOT the information is NO LONGER REPORTED OR IF THE INFORMATION IS MODIFIED IN ITS CURRENT REPORTING to a LESSER NEGATIVE FORM!

We do this by first determining if the reported negative (neutral) information falls under what we define as DELINQUENCY-CONDITIONED negative data OR if we define it as being DEROGATORY-CONDITIONED negative data! Below is a explanation of what is required fn the credit reporting agencies for reporting compliant which is regulated by the FCRA:

Read More: http://www.e-oscar.org/about-e-oscar.aspx